Javier Milei Appears in NY Complaint About $LIBRA Cryptocurrency Fraud

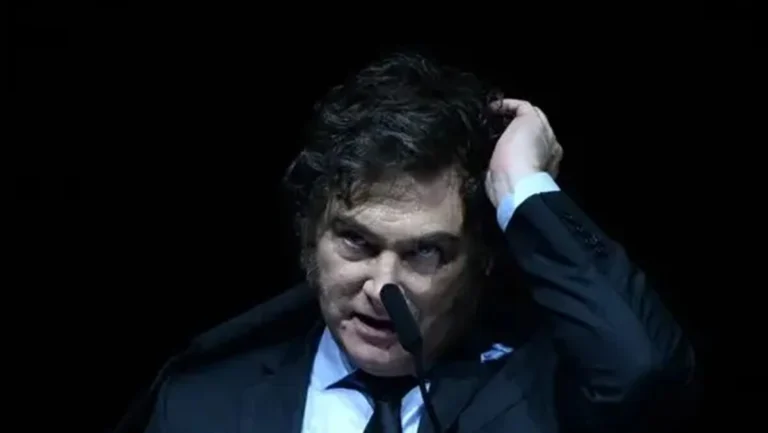

Argentine President Javier Milei. X/ @PeladoStream

July 30, 2025 Hour: 9:41 am

At this stage, however, Milei is not among the defendants, as he enjoys immunity in his capacity as Argentine president.

A court filing by the plaintiffs in a class-action lawsuit in New York accuses Argentine President Javier Milei of carrying out a “highly misleading” and “strategically timed” promotion to give $LIBRA a false appearance of legitimacy and government affiliation at the time of the token’s launch.

RELATED:

Milei Dissolves Investigative Unit Probing $Libra Cryptocurrency Scandal

The document states that “tens of thousands of reasonable consumers were misled” and that the “investment project” Milei referenced in his Feb. 14 post on X linking to the cryptocurrency “was false.”

The civil filing being handled by Judge Jennifer Rochon’s court names Hayden Davis, founder of $LIBRA, and his company Kelsier Ventures; Julian Peh and his firm Kip Protocol, which collaborated on the creation of the $LIBRA project; and Benjamin Chow, former CEO of Meteora, the platform used in the cryptocurrency fraud. At this stage, Milei is not among the defendants, as he enjoys immunity in his capacity as Argentine president.

However, the court declaration is part of a request by attorneys from Burwick Law and Hoppin Grinsell to maintain the freeze on 57,654,371 USDC (a dollar-pegged cryptocurrency), along with any other $LIBRA proceeds held in two specifically identified crypto wallets, named LIBRA Wallet 1 and LIBRA Wallet 2.

The plaintiffs are specifically seeking a preliminary injunction to block access to those assets until the conclusion of the trial, in order to secure the recovery of what they claim to have lost.

“When tens of thousands of investors lost more than US$280 million in a coordinated cryptocurrency fraud, they turned to this Court to preserve the proceeds of that fraud,” Pagina 12 reported.

“The defendants now ask this Court to look the other way and treat digital assets—which can be moved with the click of a button through anonymous networks—as if they were cash safely stored in a bank vault,” it added.

teleSUR/ JF

Sources: Pagina 12 – El Pais