Argentina's former Minister of Finance Axel Kicillof criticized the the country's new President Mauricio Macri for making a bad deal for Argentina in negotiating with holdout creditors, known as the "vulture funds."

In a special op-ed published Sunday by Argentine daily Pagina 12, the economist criticized Macri for even entering into negotiations with creditors, but furthermore added that the current president is getting a bad deal.

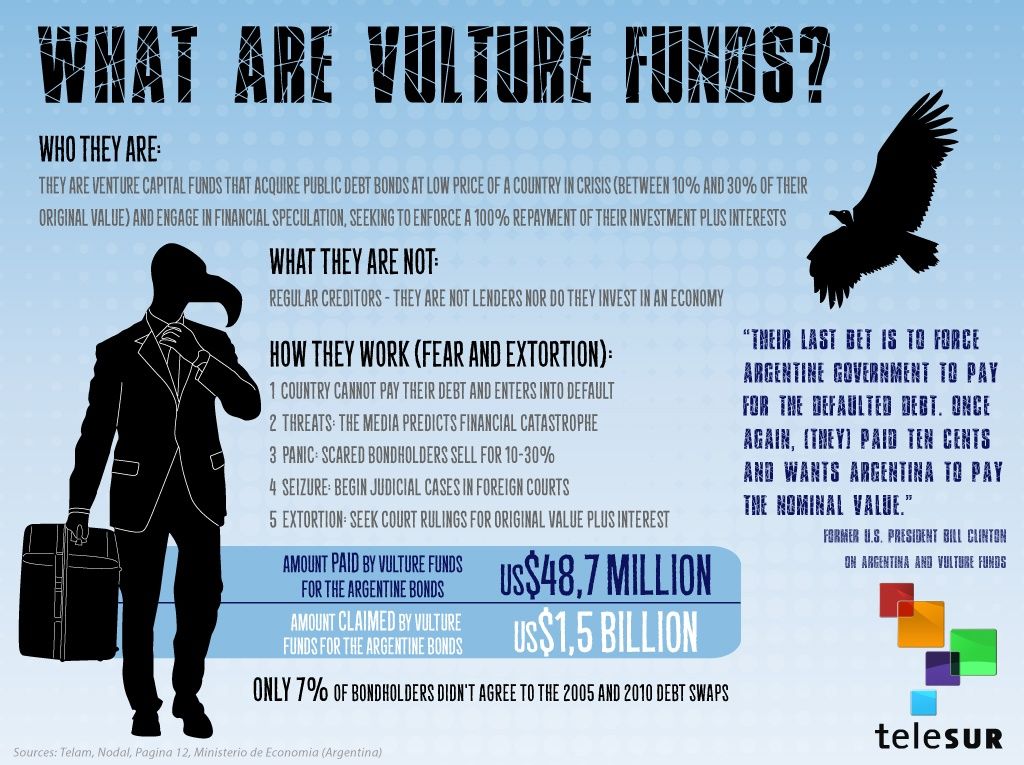

IN DEPTH: Explaining Argentina's Vulture Funds

According to the economist, official sources tried to tell the public earlier this month that Macri's government will propose to creditors that Argentina receive a 40 percent rebate on interest if the country pays back their debt in full. These sources also added that the president “aims to get more removed in exchange for paying in cash.”

However, according to Kicillof, the day after this announcement was made, Macri's true offer was revealed to be not as hard hitting as his administration promised, which was only a 25 rebate on the debt payment, if paid in cash.

“In one day, they lost US$1.1 billion in rebates,” said Kicillof.

“It is true that no one was using the 'aggressive' adjective to qualify the offer, but neither did the official media dare to call it by its real name: 'shameful.' Some might call it 'generous' but the generosity is exercised with one's money, and in this case, its that of Argentines,” added Kicillof.

OPINION: Tides of Returning Neoliberal 'Change' in Argentina

The economist also added that while he was finance minister under the previous administration of Cristina Fernandez the vulture fund negotiators were offering a much more generous deal in response to Argentina's hard-line stance against them.

The credit holders went from offering an initial 15 percent rebate on the debt if paid in long-term bonds, to upping their offer to a 30 percent rebate paid in long-term bonds. The Fernandez administration, however, stayed firm on their unwillingness to negotiate or spend Argentines' tax dollars on repaying the debt.

Background

Argentina has been struggling with the vulture funds since it defaulted on its US$100-million loan in 2001.

In July 2014, U.S. Federal Judge Thomas Griesa controversially blocked a deposit of US$539 million from the Argentine government, instead demanding holdout claims be paid in full. All the while, interest has been accruing on the debt.

Shortly afterward, Argentina declared a “partial default” despite showing the will and capacity to pay 90 percent of its creditors on a month-by-month basis.

Since then, Griesa has increased pressure on Argentina by directing international financial firms to not process certain payments and blocking a plan to rollover some of Argentina's debt.

RELATED: Argentina: Vulture Funds Negotiate With Macri Administration